- Services

- Industries

- Automotive

- Battery

- Building inspection

- Fire alarms system testing

- Household appliances

- Installation materials

- Industrial machinery

- IT & audio video

- Laboratory, test & measurement

- Lighting equipment

- Maritime, oil & gas

- Medical & healthcare equipment

- Military & aerospace product testing

- Wireless & telecom

- Resources

- About

- Blog

- Events

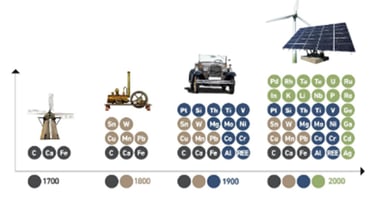

A world with 8 billion people, where all are striving for a better standard of living, have to make drastic changes soon in order to control the use of carbon. Amongst the many necessary measures, is more use of other minerals than those having fueled the exponential technical development since the industrial revolution, i.e. during the past 200-300 years.

In the need for transition to clean energy, the availability of critical minerals is a major challenge. Clean energy technologies such as solar photovoltaic (PV) plants, windmill farms and electric vehicles (EVs) generally require much more minerals to build than fossil fuel-based systems. A typical electric car requires six times the mineral inputs of a conventional car, and an onshore wind plant requires nine times more mineral resources than a gas-fired plant.

Since 2010 the average amount of minerals needed for a new unit of power generation capacity has increased by 50%. Lithium, nickel, cobalt, manganese and graphite are crucial to battery performance, longevity and energy density. Rare earth elements are essential for permanent magnets that are vital for wind turbines and EV motors. Electricity networks need large amounts of copper and aluminum with copper being a cornerstone for all electro technologies.

The shift to clean energy implies a huge demand for these minerals. EVs and battery storage have already displaced consumer electronics to become the largest user of lithium and are set to be the largest end-user of nickel by 2040. A modern EV also typically contains 60-80 kg of copper. Much copper is needed for new grid lines too due to the expansion of electricity networks.

Production of many energy transition minerals is quite geographically concentrated. For lithium, cobalt, and rare earth elements, the world’s top three producing nations control well over three-quarters of global output. Congo (DRC) and China (PRC) alone control around 70% of the global production of cobalt and rare earth elements.

China’s share of refining is around 35% for nickel, 50-70% for lithium and cobalt, and nearly 90% for rare earth elements. Chinese companies have also made substantial investments in overseas assets in Australia, Chile, Congo, and Indonesia. High levels of concentration combined with complex supply chains, increase the risks that could arise from physical disruption, trade restrictions, or other developments in major producing countries.

The EU, which relies heavily on imports, is establishing a special regulation, Critical Raw Materials Act, “for ensuing secure and sustainable supply chains for a green and digital future.”

The regulation shall also improve EU’s capacity to monitor and mitigate risks of disruptions and enhances circularity and sustainability. To diversify the supply by 2030, clear benchmarks are set for domestic capacities in terms of shares of EU's annual consumption:

- Minimum 10% for extraction,

- Minimum 40% for processing,

- Minimum 15% for recycling,

- Maximum 65% of the annual consumption at any relevant stage of processing from a single third country.

Negotiations are also in process for a Critical Materials Agreement between EU and the US.

Further information on the role of critical minerals in clean energy transitions can be seen here andpress release by EU commission on Critical Raw Materials can be seen here.

(Article is based largely on an IEA report: and announcements by the European Commission; edited by T.Sollie)